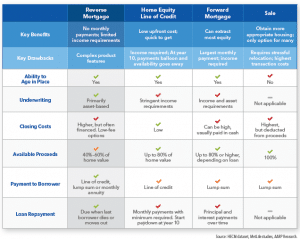

While we continue to persevere during these trying times, many Americans are struggling with financial hardships due to unemployment, losses in the stock market, and the pandemic. There are many loan options available, but some may be more difficult to qualify for in the current economic environment. The following information could help determine which product could be right for you.

Home Equity Line of Credit

A Home Equity Line of Credit (HELOC) can be a flexible option if you need to borrow money and have a solid income stream and good credit.

- A HELOC provides a revolving line of credit, instead of one lump sum.

- The loan is for a specific time period (loan term) and allows you to borrow up to its maximum amount during the loan term.

- Adjustable or fixed interest rate available, depending on lender.

- A HELOC uses your primary residence as collateral against the loan and is one factor in deciding how much you can borrow based on the value of your home.

Forward Mortgage or Cash-out Refinance

A cash-out refinance is a loan option that allows you to access the equity in your home by refinancing with a new forward mortgage. Note that many lenders typically require employment verification at the time of application, and then again within 48 hours of closing.

- A cash-out refinance replaces your existing home loan with a new loan and loan terms.

- The new loan balance is greater than your current loan, with the difference “cashed-out” to you as the proceeds.

- There are also closing costs that are usually 3-6% of the loan amount1 in addition to requiring mortgage insurance if more than 80% of the home’s value is borrowed.2

Reverse Mortgage

A reverse mortgage enables you to access a portion of your home’s equity without a minimum credit score requirements or income/employment verification.

- With a reverse mortgage, there are no monthly mortgage payments.3

- Only 40-60% of your home equity is available to cash-out.

- The youngest borrower must be at least 62 years of age.

- Loan proceeds can be received as equal monthly payments, equal monthly payments for a fixed period of months, or the ability to draw on a line of credit at any time (and in any amount) until the line of credit is exhausted.

- Borrowers can also receive one lump sum which has a fixed interest rate.

If you are looking for a flexible solution that allows you to tap into your home’s equity a reverse mortgage may be an option. To learn more, call 1-800-976-6211 to speak with a licensed loan officer.

Important Disclosures

1https://www.nerdwallet.com/blog/mortgages/refinance-cash-out/

2https://www.zillow.com/mortgage-learning/private-mortgage-insurance/

3 Your current mortgage, if any, must be paid off using the proceeds from your HECM loan. You must still live in the home as your primary residence, continue to pay required property taxes, homeowners insurance, and maintain the home according to FHA requirements. Failure to meet these requirements can trigger a loan default that may result in foreclosure.