Senior homeowners interested in eliminating their monthly mortgage payments1 with a reverse mortgage will be happy to learn they will likely end up saving a significant amount of money under the new HUD guidelines. The recent changes, which went into effect on October 2nd, can result in thousands of dollars in savings each year in the form of mortgage insurance premiums (MIP) and interest over the life of the loan.

Upfront MIP Simplified – The upfront closing cost required to setup FHA mortgage insurance has been simplified overall and the fees have been reduced for many borrowers. The amount for this is now 2% of the appraised home value, a cost that is most commonly financed into the balance of the loan.

Ongoing MIP is Reduced – In addition to the changes in upfront costs, the annual FHA insurance premiums have been reduced from 1.25% to 0.5% of the outstanding mortgage balance. This change can result in significant savings and also reduce MIP fees being added to the loan each year.

Interest Rate Margins are Down – Interest Rates are down based on today’s market rates. Compared to last month, rates are down an average of 30-50 basis points! Even though with a Reverse Mortgage you are not required to make monthly mortgage payments, lower rates equal less interest added onto the balance of your loan each year (preserving more equity for your heirs).

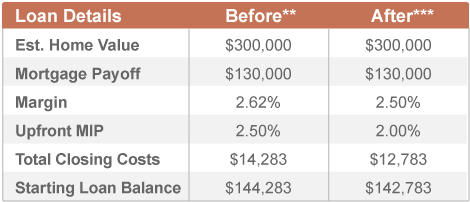

Overall, these changes result in significant savings for borrowers over the life of the loan. Our side by side comparison below shows the same loan taken out under the previous and new HUD guidelines. After 10 years, the borrower will have saved $23,638 and after 20 years they will have saved $75,573.

Example

Mary and Joe are 75 and 76 years old and bought their current home for $212,000 in 2005.* They have built up equity in their home and would like to use a portion of that equity to live a more comfortable retirement by improving their monthly cash flow. By eliminating their monthly mortgage payment1 of $963 they can free up over $10,000 in cash each year to spend however they choose.

Mary and Joe’s home is now worth $300,000, which means they have enough equity to pay off their existing mortgage of $130,000. Additionally, with the new HUD guidelines, Mary and Joe will end up preserving an extra $44,432 in home equity over the next 15 years. (See Table Below)

After 20 years have passed, Mary and Joe will have preserved an extra $75,577 in home equity as a result of lower MIP and interest rates. On top of that, by eliminating their monthly mortgage payments1, Mary and Joe have improved their cash flow during that same period by $208,001.55

*This example is based on a conventional 30 year fixed rate mortgage with a 5.5% interest and a starting loan balance of $169,600.

**This example is based on the youngest borrower who is 75 years old, a variable rate HECM loan with an initial interest rate of 4.43% (which consists of a Libor index rate of 1.805% and a margin of 2.625%). It is based on an appraised value of $300,000, origination charges of $5,000, a mortgage insurance premium of $7,500, other settlement costs of $2,783, a lender credit of $1000, and a mortgage payoff of $130,000; amortized over 145 months, with total finance charges of $111,075 and an annual percentage rate of 5.68%. Interest rates may vary.

***This example is based on the youngest borrower who is 75 years old, a variable rate HECM loan with an initial interest rate of 4.305% (which consists of a Libor index rate of 1.805% and a margin of 2.50%). It is based on an appraised value of $300,000, origination charges of $5,000, a mortgage insurance premium of $6,000, other settlement costs of $2,783, a lender credit of $1000 and a mortgage payoff of $130,000; amortized over 145 months, with total finance charges of $111,074.91 and an annual percentage rate of 4.81%. Interest rates may vary.

As with any loan product, there are pros and cons to consider with a reverse mortgage. It is important to determine your financial goals and whether the product is the right fit for you. For example, are you planning to live in your home for the next several years or do you plan to move? Would you like to make monthly payments on a loan, or prefer to have no mortgage payments? We encourage you to speak with one of our licensed reverse mortgage advisors to get the facts you need. Your loan advisor will:

- Determine if you meet the basic eligibility requirements

- Get a better understanding of your financial goals, and

- Recommend the best loan product for your needs.

For more information, call 800-976-6211 or try our free reverse mortgage calculator first.

Important Disclosures:

1 Borrowers must still live in the home as their primary residence, continue to pay required property taxes, homeowners insurance, and maintain the home according to FHA requirements. Failure to meet these requirements can trigger a loan default that may result in foreclosure.

2 Federal Housing Administration (FHA) mortgage insurance premiums (MIP) will accrue on your loan balance. You will be charged an initial MIP at closing. The initial MIP will be 2% of the home value but not to exceed $12,723. Over the life of the loan, you will be charged an annual MIP that equals .5% of the outstanding mortgage balance.