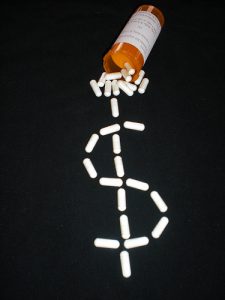

Increasing Health Care Costs. It’s probably no surprise that the cost of staying healthy is on the rise. Even healthy seniors may be feeling the pinch of the increasing cost of health care. Health insurance often increases with age and even retirees with Medicare will still have to pay out of pocket for many health care costs. A 2013 Fidelity Investments study1

Underestimating Life Expectancy. Because health care technology has improved so much in recent years and people are taking better care of themselves, seniors are living longer. According to the CDC and the U.S. National Center for Health Statistics (part of the CDC), the average life expectancy is 78.7 years. The life expectancy for men born in 2009 is 76 years old and for females it’s 80.92. Sadly, many retirees outlive their savings and end up scrimping to make ends meet to cover even the most basic of living expenses.

Taking Care of Elderly Parents. Because people are living longer, aging parents may move in with their adult children. Often these children are facing retirement themselves and the cost of caring for their parents may cause financial strain. Some children choose to retire early to take care of their parents at home rather than move their parents to an assisted living facility or hire a home care assistant. Even if an elderly parent does not require physical assistance from their children, many may still require financial help.

Even for retirees who have saved for retirement, this time could be a period of stress and frustration if they run into common retirement obstacles without a plan. Retirees who are struggling to make ends meet may have another option to live the retirement they dreamed of. Homeowners who are at least 62 years old, and either own their home outright, or have significant equity in their home may be eligible for a reverse mortgage loan. This type of loan allows qualified homeowners to tap into the equity in their home to receive cash or a line of credit. The funds from a reverse mortgage loan can be used however the borrower chooses and the loan does not have to be repaid until the borrower passes away or moves out of the home. For more reverse mortgage information, call 800-976-6211. To see how much home equity you can unlock, use our reverse mortgage calculator.