On 05/27/20 the Intercontinental Exchange (ICE) Benchmark Administration published a new 10-year London Interbank Offered Rate (LIBOR) SWAP rate1 which means reverse mortgage applicants are eligible to receive more money than they were before. The previously published rate in February already sat at a record low of 1.22%.1

These lower reverse mortgage interest rates mean that homeowners 62 and older may be able to access more cash from their home equity than ever before. Plus, unlike a traditional home equity loan or home equity line of credit (HELOC), a reverse mortgage line of credit can never be frozen or reduced if market conditions change.

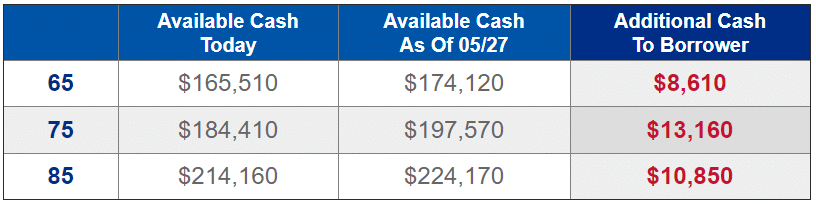

Example of Increase In Cash Available To Homeowner

$350,000 Home Value, 2.375% Margin*

Interested in taking advantage of these historically low interest rates? Call 800.976.6211 to speak with a licensed loan advisor today!

Important Disclosures

*These examples are based on 6 separate scenarios where the youngest borrower is 65 years old, 75 years old, or 85 years old. For all quotes pulled before 5/27/2020, the variable rate HECM loan has an initial interest rate of 3.130% (which consists of a Libor index rate of .755 % and a margin of 2.375%). It is based on an appraised value of $350,000, origination charges of $5,500, a mortgage insurance premium of $7,000, other settlement costs with a total of $14,740 in closing costs. Interest rates may vary and the stated rate may change or not be available at the time of loan commitment. For rates after 5/27/2020, the variable rate HECM loan with an initial interest rate of 3.06% (which consists of a Libor index rate of .685 % and a margin of 2.375%). It is based on an appraised value of $350,000, origination charges of $5,500, a mortgage insurance premium of $7,000, other settlement costs with a total of $15,580 in closing costs. Interest rates may vary and the stated rate may change or not be available at the time of loan commitment.