The Great Recession affected Americans across the age spectrum, but older Americans especially have been dealt a tough hand as they have less time to recover from the economic downturn and are being forced to delay retirement.

“Boomers have had a rough ride over the past several years. The recession and its aftermath have left many without jobs, having exhausted their savings, and with homes they can neither afford nor sell,” says AARP in their report titled Boomers and the Great Recession

AARP wrote the report in 2012 after conducting a survey in October 2010 and a follow up survey in August 2011 on boomers between the ages of 50 and 64 that were in the labor force or had been at some point between December 2007 and October 2010.

Boomers Struggling to Recover from Recession

Since the beginning of the recession, many boomers have struggled financially, with income declining for more than two-fifths of those surveyed between 2007 and 2010, according to AARP in the 2012 report.

Two-thirds of boomers reported some reduction in retirement savings in the three years leading up to October 2010.

More than half felt “less secure” financially than they had in 2007, even though by 2010 the recession had been officially over for more than a year and the economy was in a recovery phase.

The unemployed or those recently reemployed both mentioned experiencing financial hardship as a result of losing their jobs or being out of work for extended periods of time.

Many also struggled with lower pay rates and a loss of savings upon regaining employment, and fewer than half of the reemployed felt they would soon be financially “back on track” for retirement despite having a job again.

As a result, two-fifths of boomers reported a change in the age at which they planned to retire, and a large majority of those (more than four-fifths) said they were expecting to retire later than originally planned.

Using a Reverse Mortgage to Improve Retirement?

In the aftermath of the recession, many older adults are dealing with the fallout of tapping into their retirement and savings accounts, and they don’t have as much time as younger people to let their portfolios recover. However, many boomers do still have an important asset: their homes, and all the equity they’ve accrued over the years.

Getting a reverse mortgage loan and drawing upon that home equity can be a way to help supplement your retirement income. Obtaining a Federal Housing Administration-insured Home Equity Conversion Mortgage (HECM) Saver reverse mortgage and using the line of credit as a “standby” may help increase retirement portfolio survival rates, said financial planners from Texas Tech University in a study published in the Journal of Financial Planning.

According to the financial planner’s findings, here’s how a reverse mortgage loan can help: A line of credit through the Saver program, which offers lower up-front origination fees in exchange for a smaller loan amount, can give borrowers control over when and how much they draw down their equity. This strategy can be a way to preserve retirement portfolios, allowing them to continue recovering and growing.

Could a Reverse Mortgage Benefit You?

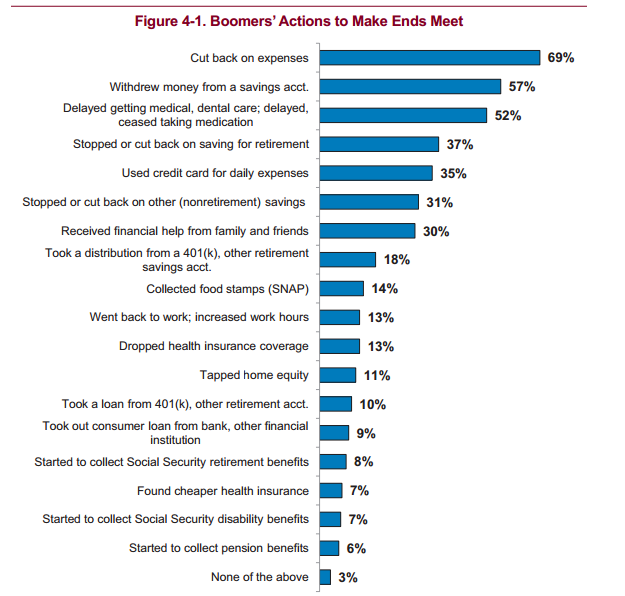

More than one in ten boomers participating in the AARP survey reported tapping home equity as a way to make ends meet in response to the recession.

If you’re a boomer approaching retirement and you’re worried you aren’t financially prepared, consider consulting with a trusted financial advisor to find out how a reverse mortgage could work in your situation.

Whether you choose a HECM Saver or another reverse mortgage option, the program can help in a variety of ways: It could give you extra room in your monthly budget, allow you to pay off an existing mortgage, or function as a safety net in the event an unexpected expense was to arise.