For a long time, reverse mortgages have been negatively perceived as a last resort for people who are strapped for cash in retirement. Another common misconception is that a reverse mortgage is like selling your home to the bank. However, these perceptions are far from true.

Not only do homeowners retain the title on their homes when taking out a reverse mortgage1, but the funds made available with a reverse mortgage can also be a valuable retirement tool. More and more financial planners are beginning to recommend reverse mortgages as part of a long-term retirement plan. The mostly highly recommended strategy is to set up a reverse mortgage as early as you are eligible and then not touch the funds until they are needed.

With this approach, the amount of equity you are able to access actually grows to a larger amount than if you simply wait until fund are needed to open the reverse mortgage.

Using Home Equity as Part of a Comprehensive Retirement Plan

Wade D Pfau, Ph.D., CFA, award winning journalist and professor of retirement income at The American College, explains the benefit of using home equity in retirement in his recent research paper, “Incorporating Home Equity into a Retirement Income Strategy.”

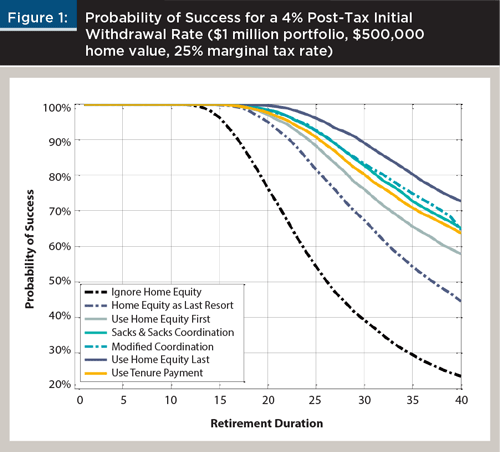

Using simulated market conditions, (including stocks and bonds, home prices, short-term interest rates, and inflation), he explores different approaches for incorporating home equity into a retirement income plan through the use of a reverse mortgage:

- Ignore Home Equity – This was the only strategy that did not use any home equity in retirement.

- Home Equity as a Last Resort – This strategy completely depleted the investment portfolio before opening a line of credit with a reverse mortgage.

- Use Home Equity First – This strategy used all available home equity first to allow the retirement savings investment portfolio more time to grow before withdrawing funds.

- Sacks& Sacks Coordination – This strategy used home equity following years when the retirement savings investment portfolio experienced negative market returns, allowing the retirement savings portfolio time to recover.

- Modified Coordination – This strategy was used in coordination with the retirement savings investment portfolio. Whenever the account dipped below 80% of what would be needed for long term retirement income, home equity would be used as income.

- Use Home Equity Last – This strategy slightly differed from the “Home Equity as a Last Resort” in that the line of credit was opened at the start of retirement but not used until the retirement savings investment portfolio was depleted.

- Use Tenure Payment – This strategy opened the line of credit at the start of retirement but then elected for annual tenure disbursements from the reverse mortgage. Any other additional spending needs beyond the tenure payments were withdrawn from the retirement savings investment portfolio.

Surprisingly and perhaps counter-intuitively, the strategy that resulted in the highest probability of a long term, sustainable retirement plan was the “Use Home Equity Last” method, which opens a line of credit at the beginning of retirement but does not use it until the retirement savings

Public Perception About Reverse Mortgages Are Shifting

More and more analysts and news outlets are beginning to realize the value in a reverse mortgage as a tool for leveraging your home equity and are recommending as a strategic tool in retirement planning. Jane Bryant Quinn is a personal finance writer who has contributed regularly for AARP and is author of “How to Make Your Money Last.” In an interview with TIME magazine, she discusses the benefits of opening a line of credit on your home early.

“As soon as you’re 62, you can take a reverse mortgage. Here the idea is that you take the mortgage, but you don’t take a large sum. You take a credit line against the value of your house. And if you never borrow, other than for closing costs, but otherwise, you don’t borrow against it, the amount of credit available increases every year by the same rate you are paying on your reverse mortgage.” 3

Variable Rate HECMs

Variable Rate HECMs with a line of credit disbursement are still one of the lesser known options for reverse mortgages. With this type of reverse mortgage, the line of credit grows at a pre-determined rate year over year. If the funds are left unused long enough, the line of credit may even grow to exceed the value of your home.

Having a line of credit to draw on as needed can be used in many ways. Here are just a few scenarios where it could be helpful to have a line of credit available through a HECM:

- In case of an emergency – If you have planned your retirement income to provide for your monthly expenses, what do you do when an unexpected sum of money is needed? Having an available line of credit can provide a good safety net in case you need extra money in an emergency.

- Long-term care or medical bills – A HECM line of credit can provide resources to help you pay for long-term care insurance, in-home care or medical bills.

- Providing flexibility in other investments – When you decide the time is not right to liquidate investments or draw down other assets, your line of credit can provide needed funds.

Not For Everybody

A reverse mortgage can be of great benefit depending on your financial goals, but as with any other type of financial product, reverse mortgages are not an option for everybody. In order to qualify, you must meet certain requirements:

- The youngest borrower on the home’s title must be at least 62 years of age

- The home must be your primary residence

- The home must have sufficient equity and you must be able to pay off your existing mortgage using the HECM proceeds.

- Most single-family homes, townhomes, approved condominiums and manufactured homes are eligible.

As with any financial decision, you should carefully weigh the benefits and risks before making a decision. We strongly encourage you to consult a financial advisor for your retirement planning needs. You may also direct any questions about a HECM to a licensed mortgage advisor who specializes in reverse mortgages.

References

1 You must live in the home as your primary residence, continue to pay required property taxes and homeowners insurance, and maintain the home according to Federal Housing Administration requirements. Failing to meet these requirements can trigger a loan default that results in foreclosure.

2 Pfau, Wade D. 2016. “Incorporating Home Equity into a Retirement Income Strategy.” Journal of Financial Planning 29 (4): 41–49.

3 Rosato, Donna. (2016, May 11). Why a Reverse Mortgage Could Be Right for You. TIME Magazine. Retrieved from: http://time.com/money/4321577/reverse-mortgage-benefits/.