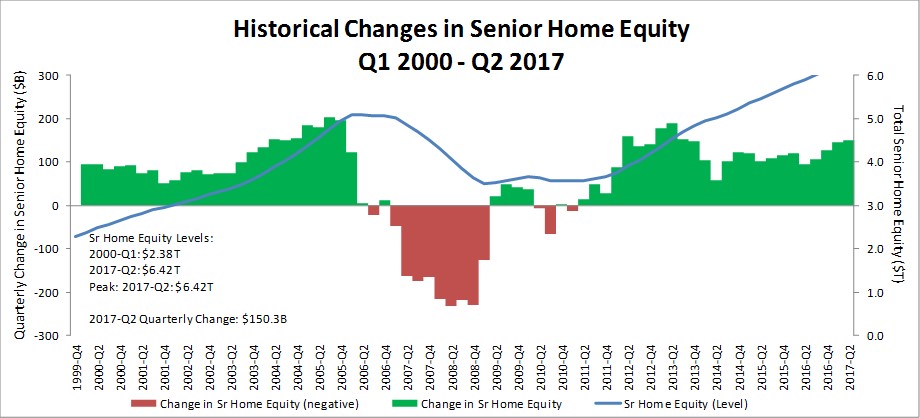

Homeowners age 62 and older saw an increase in home equity of 2.4% in the second quarter of 2017 for a combined total of $162 billion.1 According to the proprietary index, developed by NRMLA and RiskSpan in 2000, the driving factor of the increase in equity appears to be home values. The index, which takes into account changes in seniors’ home equity and mortgage debt, has seen a continual upward swing each year since the beginning of the housing market recovery in 2010. The upward trend does not yet appear to be slowing.

This increase in home equity comes as welcome news at a time when many seniors are faced with managing their own retirement savings plans in the midst of rising medical expenses. Home equity can be a much needed resource for living a more comfortable retirement.

In a statement announcing the index findings, NRMLA president and CEO Peter Bell describes home equity as a solution to growing retirement and healthcare costs:

“There is little doubt that healthcare spending per person will continue to increase. This is a particularly sobering fact for older Americans who can expect to spend between $200,000 to $400,000 out of pocket for medical expenses during retirement,” Bell said in a statement announcing the results.

“Housing wealth provides older homeowners with an available source of funds to manage the costs of caregiving and other expenses incurred in the last third of life,” Bell said.

A Home Equity Conversion Mortgage (HECM), also commonly known as a reverse mortgage, offers senior homeowners the means needed to tap into their home equity and turn it into usable cash. With a reverse mortgage, homeowners are able to eliminate their monthly mortgage payments2 and access a portion of their home equity without the need to sell the home. Additionally, all HECM reverse mortgages are insured by the Federal Housing Administration (FHA)3 and non-recourse, so even if home values do not remain at their current levels, the homeowner will never owe more than the value of the home loan.

If you are interested in accessing a portion of the equity in your home through a HECM, the first step is to get a free eligibility assessment. A licensed loan advisor will determine if you meet the basic eligibility requirements, get a better understanding of your financial goals, and recommend the best product for your needs. For more information, call 800-976-6211.

Important Disclosures:

1 Housing Wealth for Older Homeowners Reaches $6.42 Trillion in Q2 2017. National Reverse Mortgage Lenders Association. https://www.nrmlaonline.org/about/press-releases/housing-wealth-older-homeowners-reaches-6-42-trillion-q2-2017

2 You must still live in the home as your primary residence, continue to pay required property taxes, homeowners insurance, and maintain the home according to FHA requirements. Failure to meet these requirements can trigger a loan default that may result in foreclosure.

3 Federal Housing Administration (FHA) mortgage insurance premiums (MIP) will accrue on your loan balance. You will be charged an initial MIP at closing. The initial MIP will be 2% of the home value but not to exceed $12,723. Over the life of the loan, you will be charged an annual MIP that equals .5% of the outstanding mortgage balance.